Freelancing Without the Burnout: The Vacation Savings Plan

A simple calculator to help you take time off each year.

“I work all the time.”

I hear this all the time from freelancers. They can’t figure out how to step away from client work for a week or two per year.

Yet, if you were an employee, you would take time off (hopefully!) Vacations, staycations, or just a brain break are necessary to recharge.

Juggling the client work is one factor. Most of my work is ad hoc, so if I’m taking time off, I let my clients know a few weeks in advance. But that also means I’m not earning any income while I’m on vacation.

I use a simple formula to determine how much I need to set aside each month to “pay myself” (cover the lost income) while I’m not working.

Step 1: Determine how much time off you want to take per year

For most employees in the United States, two weeks of vacation per year is standard and, in my opinion, way too low.

One of my former employers had unlimited PTO. An employer after that had four weeks per year.

This year, as a freelancer, I’ll be taking about five weeks: one week in the spring, one week in October, one week at Thanksgiving. And two weeks toward the end of the year and into January next.

At a minimum, I think you should take two weeks per year — at least a week every six months. And as you become more successful as a freelancer, take additional time off. You deserve it.

If necessary, depending on how you work, you’ll also want to factor in holidays when you may not be working. The U.S. recognizes twelve federal holidays. If those are additional days you won’t be working and would affect your income, plan for those as well.

Step 2: Calculate your weekly income

Even if you’re not paid weekly, you’ll want to calculate your average weekly income. Don’t use monthly — the math won’t work out as well since each month is about 4.3 weeks long. You’re trying to calculate how much income you won’t earn if you take one week off.

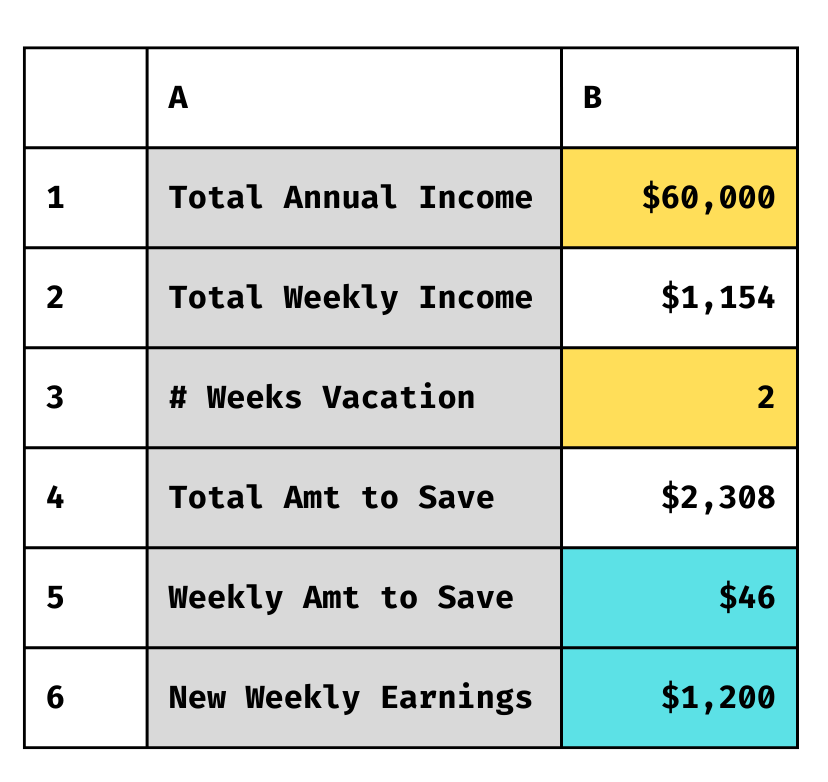

If you’re not sure, start with the amount you earned last year and divide by fifty-two. For example, if you earn $60,000 per year as a freelancer, your weekly income is about $1,154.

Step 3: Calculate how much you need to save

Next, you’ll take your weekly income and multiply it by the number of weeks of vacation you want to take.

If your weekly income is $1,154 and you want to take two weeks off per year, you need to save $2,308 per year. If you plan to take two weeks off, you're only working 50 weeks out of the year. You have 50 weeks to save $2,308 or $46 per week ($2,308 / 50).

Then you'll need to add that to your weekly income. To cover your vacation, you need to earn $1,200 per week ($1,154 + $46). That still earns you about $60,000 per year for your working weeks ($1,200 x 50 weeks of working), and gives you the cushion to set aside money for your vacation savings.

During the months when you take a week off, you’ll earn less (or zero). You’ll draw money out of your savings account to cover those weeks.

Step 4: Adjust your variables

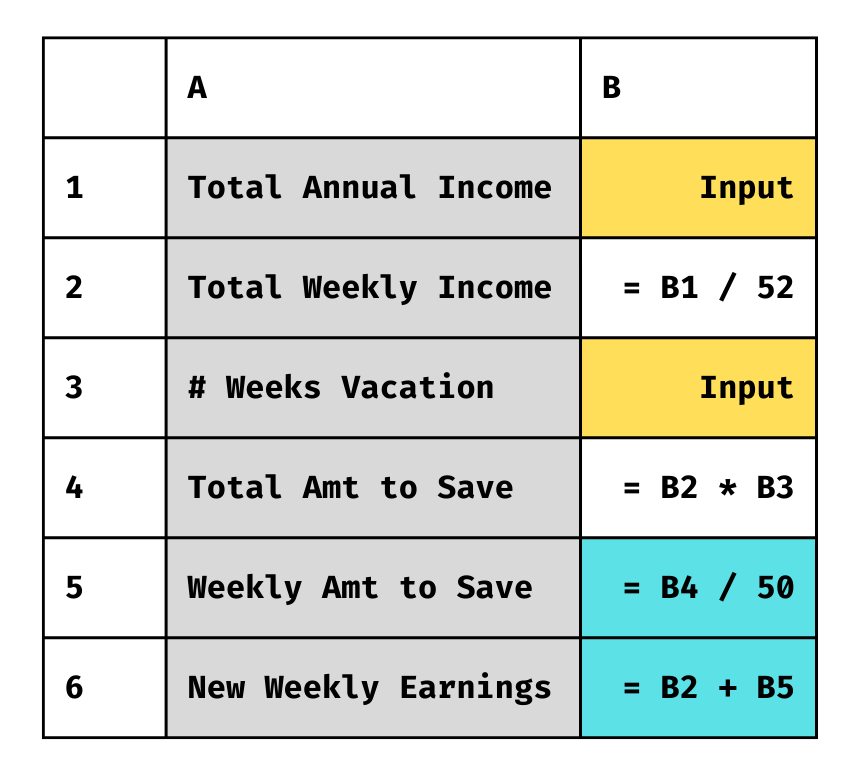

I made a simple GSheet to calculate the amount I need to save each month. The formulas look like this.

I input my projected amount of annual income and the number of weeks I plan to not work each year. In the given example, it looks like this:

Unlike an employee, your freelance income might be variable — which means you should adjust as conditions change. Maybe you’re earning less per year, so you lower your income or the amount of vacation you want to take. Or the opposite — you’re doing really well and want to take more time off.

I have a general savings account for my freelance income and that’s where I put my vacation money.

In a pinch, it can always act as a rainy-day fund in a bad month. Just try to replenish your vacation money when you can so you don’t end a year without taking any time off.

Paying for your vacation

Of course, all of this assumes that you have extra money every month: that you’re earning more than your basic living expenses.

If you’re not to that point yet, and the amount of money coming in and going out is the same, I encourage you to find a way to earn that little bit extra.

If the amount that you need to save is $192 per month, that’s less than $7 per day. Can you charge a client slightly more? Can you earn money through digital products or coaching services?

Because without time off, you’ll burn out, guaranteed. And as freelancers, we need to take care of ourselves.

Check out my free eBook: 17 Smart Tools Solopreneurs Need to Start, Grow, and Scale.