4 Ways to Set Your Freelance Business Up for Success

Do these things early in your freelance journey.

Recently, I was a guest on a podcast, and the host asked what I would do differently if I were starting my freelance business over again.

I gave an answer I'm sure the host wasn't expecting: Nothing. I wouldn't change a thing.

Before I became a freelance writer, I was an executive at a tech company. Because of this experience, I knew many of the ins and outs of running a business. Delivering client work was new, but I was comfortable with the "behind the scenes" work. This knowledge gave me an advantage, because I wasn't figuring things out as I worked to build a business.

If you're thinking about freelancing, here are the top things I'd recommend.

1. Protect yourself with a solid contract

Freelancers can easily find themselves doing more work than expected if the contract doesn't have a clearly defined project scope. Clients will ask for more work or changes to your existing work — without paying more. And you'll feel like you have to accommodate them because the contract doesn't explicitly say otherwise.

While all freelance work is different, here are a few musts in my contract as a freelance writer

- I will invoice based on the delivery of a first draft, not based on the final revision or client approval

- I clearly outline how many rounds of revisions I'll do, based on the length of the deliverable

- Once a client gives me an assignment, they can't cancel it for any reason

- Payment cannot be withheld for any reason

The first — invoicing based on the initial delivery of the work — is a big one for anyone in a creative field. If your invoicing is subject to a client's approval, you might be waiting forever. I have some clients who push back on this, saying that they want to approve the work first. In this case, I add a clause that I will invoice after approval or two weeks after delivery of the work, whichever comes first. That way, the client has two weeks to review and complete a round of revisions, but I'm not stuck waiting forever if the client takes longer.

2. Learn how to manage your cash

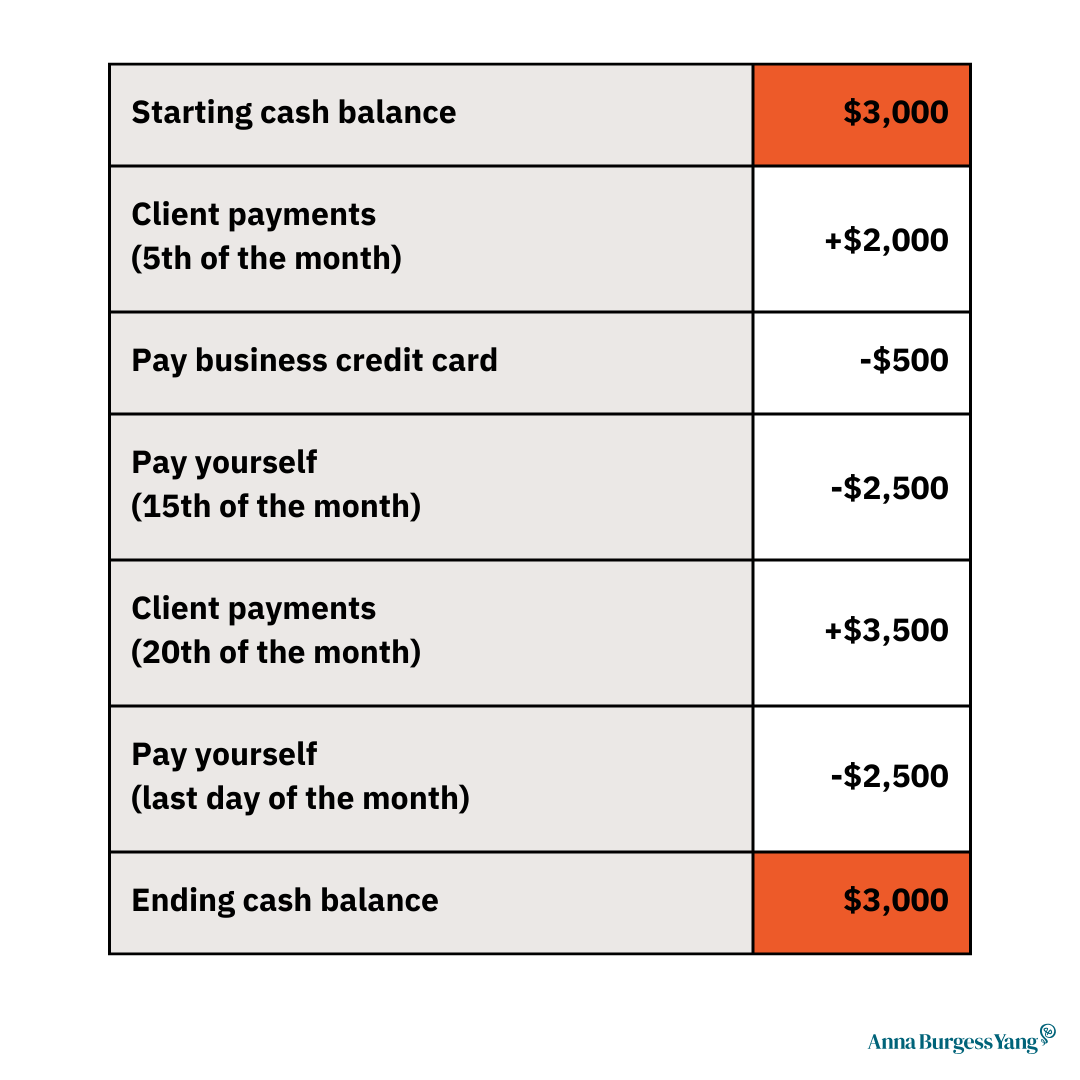

Even though freelancing goes through "feast or famine" cycles, that doesn't mean that your finances have to be on a similar rollercoaster. You can create consistency in your monthly income, even when your payments from clients are irregular. Money coming in and money going out are known as cash flow. You want to manage your cash flow in such a way that you don't come up short when you need money (because you're waiting on client payments).

Start by figuring out how much money you need per month: how much you need to earn and your expenses. Put your expenses into two buckets: personal expenses and business expenses. Next, divide your personal expenses in half and plan to "pay yourself" twice a month. For example, if your personal expenses are $5,000 per month, plan to pay yourself $2,500 on the 15th and last day of the month.

To create more consistency in your cash flow, start invoicing clients on the same day every month. Most of my clients are invoiced on the 5th of the month for all work delivered in the prior month. Invoices are either due in 15 or 30 days. That means some of my cash arrives on the 20th, and the rest arrives on the 5th of the following month. Either way, it arrives before I plan to pay myself. If you're invoicing every client on different days of the month, it's harder to manage your cash.

Finally, figure out a starting cash balance for the beginning of the month. This is the amount you need in your bank account to pay your expenses for the month — including your expected payments from clients. Here's an example:

Ideally, your starting cash balance should cover your expenses for the first half of the month. That way, if your clients pay late, you're not short on cash. It might take some time to work up to the starting cash balance you need, but it's worth making this a goal.

If your bank account has more than you need at the beginning of the month (like $3,200), move the excess to a savings account. If your starting cash balance is below what you need, move money from that savings account. This creates consistency in your monthly income, even when you have slower months.

Bonus Tip: In my monthly business expenses, I also set aside money in a savings account to "pay myself" for vacation time. If I don't work, I don't get paid, so I want to have a healthy cushion of savings to draw from in months when I have a lower income.

3. Narrow your product offering

I know many freelancers who are generalists and serve a broad range of customers. There's nothing wrong with this approach, especially as you're first getting started and need to accept any work that comes your way.

However, I've found that narrowing your product offerings does a few things. It's easier for clients to say, "Yes, you're the right freelancer for my needs because you do the exact work I need." It's also easier for project management your work because your deliverables are more consistent.

There are two ways you can narrow your product offerings:

- Subject-matter expertise: Choose a niche, such as particular topics or industries

- Type of deliverable: Offer specific services and only those services

When I first started freelancing, I would write for any type of technology company. I'd write blog posts, landing pages, sales one-pagers, case studies, and more. Now, I mostly focus on financial technology, and only write blog posts, eBooks, or editorial placements (like ghostwriting for a publication). If a client asks for something else, like email copy, I let them know that I don't do that type of work and refer them to another freelancer if I can.

If you decide to narrow your product offerings, make sure your website copy and social profiles reflect your focus. You'll also want to highlight any completed work that showcases your expertise in a portfolio or examples you send to potential clients.

4. Find a freelance community

Freelancing can be incredibly lonely and isolating. In my work, my client communication is via Slack or email and I have very few meetings. It's just me and my computer most days.

I learned about freelancing from other freelancers. I had the business knowledge, but it helped immensely to hear from other freelancers about their experiences with clients. Plus, other freelancers would share their rates which helped me learn how to price my work.

Peak Freelance is a great community and has a Slack group for freelancers (along with other resources). I connect with other freelancers on LinkedIn. I've also done several co-working sessions with groups of freelancers, where we join a video call together for some focused work time.

Solo work definitely isn't for everyone. If you're considering freelancing, keep in mind that you'll spend a lot of time working alone — with no coworkers or boss to talk to. I worked remotely for a long time before I started freelancing and it was different. Even though I was physically alone in my house, I could always ping someone on chat or call a colleague if needed. I don't have that with freelancing, which is why I've surrounded myself with other freelancers and participated in communities.

In addition to reducing isolation, freelance friends and communities can be incredible support networks. Whether you have a question, refer work back-and-forth, or simply need to vent about a terrible client, fellow freelancers are the ones who "get" it.

This article is for informational purposes only. It should not be considered legal or financial advice. Consult a legal or financial professional before making any major legal or contract decisions.

Freelance pricing is incredibly opaque, but I’ve created a free resource for fellow writers. It outlines my rates, how I think about pricing, and how my pricing has evolved over time.