The Allowance Jars and the Book Fair

I have been doing “allowance jars” with my kids (ages 10 and 7) for years. They each have three jars: Spend, Save, and Give. They earn one…

My kids choose how to spend their money.

I have been doing “allowance jars” with my kids (ages 10 and 7) for years. They each have three jars: Spend, Save, and Give. They earn one dollar per week for every year of their age, so on their birthdays, they get a raise. One dollar must go in Give, but the rest is up to them.

I opened savings accounts for both, but taking the money to the bank was a hassle. When they were younger and didn’t earn as much (and had fewer “big goals” in mind for how to spend their money) it was constantly paying me back for wanting something in the check-out line or from the school store.

But as they have gotten older, they have started to become strategic. And it is very satisfying for me to say “Oh, you want to buy that puzzle in the museum gift shop? Do you have enough money in your allowance jar?” They earn just enough that they can make those types of decisions and know that a purchase isn’t going to set them back for a month, as it did when they were only earning $4/week.

Recently, they pooled their allowance for months to buy Pokemon Sword and Pokemon Shield — two new games for the Nintendo Switch. The games together cost $120, so were foregoing any other wants for a long time.

This week was the school Book Fair, and they both wanted to go. I give them each $5 when the Scholastic Book Order comes home, but I told them that the Book Fair was extra. They had looked at books in advance, so I added up the total that they would need. Each was going to be slightly short by the amount of tax, so I told them that I would give them an advance on their allowance for that amount.

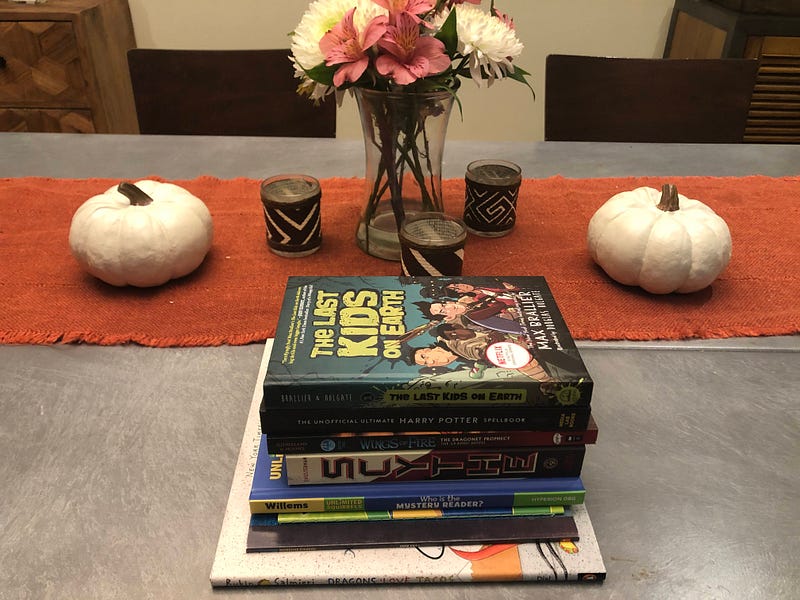

We spent an inordinate amount of time at the Book Fair. Even with prepared lists of their wants, they both wandered the tables and ended up making different choices about their books. I picked up a copy of Dragons Love Tacos for my toddler, signed by the author, and also a young adult book called Scythe by Neil Shusterman that looked intriguing. I am usually eager to fork over my own allowance for books….

The 7-year-old really wanted a Harry Potter joke book, but it was per house, and there were no copies of Hufflepuff, so I told him that I would find it on Amazon for him. The 10-year-old made a last-minute decision for a book called The Last Kids on Earth by Max Brailler, because it had a sticker that indicated it was also a Netflix series he could watch.

We made our way to the check-out line, and luckily had no one behind us. The school librarian smiled patiently as they counted out the money, mostly in $1 bills, since that’s how their allowance is received.

The next day, I took a look at their bank accounts, held at a local bank, specifically for the 10-year-old. He received an old iPhone for his birthday that has no cell service, only WiFi. He only has a handful of apps, but one of them is Goodreads.

I had usually helped him enter the books on the website, and was curious if he would do it by himself on the app. I figured Goodreads was a fairly “safe” introduction to social media. Nothing happened for several weeks, but then out of the blue a few books showed up in my feed that he had rated. He also told me that he saw another book that he might want to try, based on Goodreads recommendations.

Giving him $10/week in allowance has become a bit of a chore, since I have to constantly make sure I have enough $1 bills. Conceptually, it made sense to pay him in cash when he was younger and still learning to count, but I decided he could understand the idea of “money deposited in a bank.”

I thought I could set up an automatic transfer from my checking account to his savings account every week, and then put the app for the bank on his iPhone and let him check the balance. The only trick was wanting him to ONLY see his account and not other accounts. I set up a login for him for online banking, but it was not an automatic enrollment process, and I had a feeling that once I put in his date of birth, that the request for online banking would be rejected. It was.

So, now I think I’ll be taking him with me into the branch down the street to see if there is another way to go about this — a separate login for myself that only shows his one account or something. However, I told him that I would be setting this up and he liked the idea. Certainly will make my life easier.